Leasing and other financing organisations know that system integration is supposed to streamline operations, improve…

Target Operating Models – Why Should You Care?

Why is a Target Operating Model important to your organisation?

To succeed in today’s challenging marketplace, all organisations must be capable of a continual process of transformation and renewal. To achieve this, an organisation needs to have an in-depth understanding of its existing business operating model and how this model can be changed to optimise operations with resulting increased returns on investments, better service delivery for customers as well as new offerings.

Recent studies indicate that optimum business models are most often found in new start-up operations whereas in more established operations, operating models are often no longer appropriate for the business and challenges the unit is facing. Just because your organisation’s business model served you well in the past is no guarantee that it will be successful for the future. Business models need to be constantly reviewed and refreshed to deliver on the organisation’s goals.

Technology plays an important role in supporting your business model. However, it is only one of the pillars in supporting your business model alongside the other key pillars of organisation/people, go to market approach and process.

The reality is that many organisations do not fully understand the strengths and weaknesses of their existing business operating model and are often slow to act to conduct a deep dive analysis with a view to embracing an enhanced operating model. In this article, we look at how your organisation might approach reviewing your current operating model with the objective of moving to a target operating model that creates a platform for sustainable future growth.

What is a Target Operating Model (TOM)?

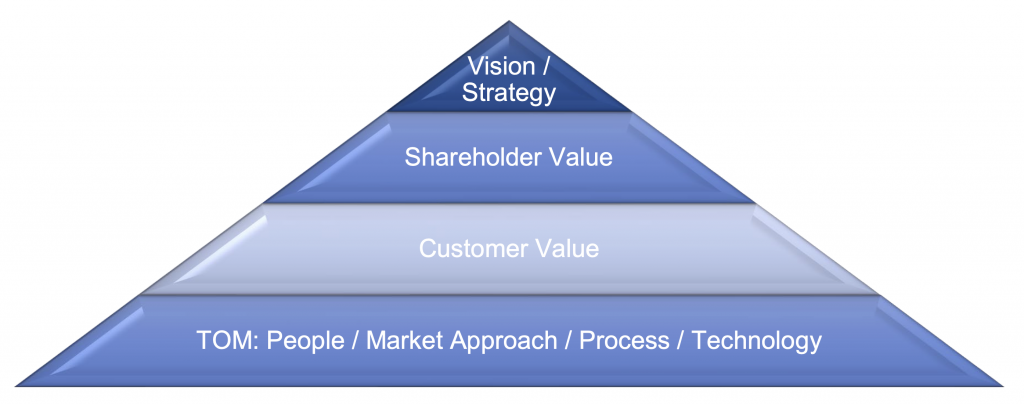

Although the term is familiar, there are various definitions on what a TOM is. We would characterise it, as is a representation of the structures needed for an organisation to create and deliver optimal value for its customers in a repeatable manner whilst delivering on the organisation’s vision and growth strategy.

Organisation, market strategy, process and technology are the key underlying components of a TOM and are critical to its success. Ultimately, the TOM should provide a visual overview of how a business can be ideally structured to implement the organisation’s strategy by showing how each of the main business activities are represented.

What are the common issues with current Target Operating Models (TOM)?

In our experience, the most common issues we encounter is a lack of effectiveness of TOMs due to several factors including:

- the inflexible nature of historic business models to support a business that is evolving its business operations. For example, a financing organisation that is moving from supporting large/complex transactions to a flow business operation.

- In the financial services business, the continuation of the historic segmentation, between ‘front’ and ‘back’ offices where it is patiently obvious, that both cannot continue to effectively operate independently of each other.

- Having an operating model that is not aligned to a specific business operation with the consequences of an organisation falling into ‘functional silos’ resulting in process in- efficiencies and a lack of communication.What are the key elements of a Target Operating Model (TOM)?There can be several aspects to a Target Operating Model but the key interdependent elements that we consider to be the critical parts of the TOM framework are:• Organisation/People • Go To Market

• Process

• TechnologyWe review each of these essential elements in turn below and outline some scenarios/questions for consideration under each of these categories.1. Organisation/PeopleThe TOM objective is to have an organisation that will support the business strategy and has clear roles/responsibilities with measurable skills and capabilities. The organisation should have the right number of people with the appropriate renumeration, skill and experience levels across the various roles. In addition, the structure should be designed to be transparent, easy to understand and adaptable to changes that will arise over time.Typical areas to be considered for a review in advance of determining the appropriate organisational structure include:- Defining the existing organisation structure in place

- Review of existing role profiles, reporting lines and number of people in each role

- Review of the type of people in each role (full time, temporary, outsourced etc)

- Completion of a competence, performance and experience audit

- Analysis of performance evaluation methods

- Analysis of remuneration and incentive schemes

- Analysis of the decision making and governance structures in place

- Analysis of the degree of headquarter control versus local/regional autonomy

- In banking/leasing entity scenario and where the entity is bank owned, determine thelevel of bank control versus the lease organisation control for key functions e.g. credit,pricing, asset management

- Review on whether the entity is functional or a product organisation

2. Go To Market (GTM)

The successful business model should have a GTM strategy that achieves the objective of delivering a range of products and /or services to its customers on a profitable and cost-effective basis. The various GTM channels should be clearly defined and operate effectively.

Let’s take the scenario of reviewing the GTM approach for a leasing/financial service provider operation with a supporting bank branch network.

Areas where we suggest that could be subject for review before deciding on the optimum GTM include:

- Analysis of overall entity’s commercial approach

- Analysis of the revenue and profitability model by product and service

- Analysis of the sales / operations approach with focus on direct and inside sales route.

- Analysis of how the supporting bank branch network is operated and controlled

- Analysis of the distribution routes to market through brokers, partnerships, others and howthis is operated and controlled

- Analysis of the typical customer profile and segmentation

- Analysis of the product and services offerings

- Analysis of regulated and non-regulated product offerings

- Analysis of ‘x as a service’ and pay per usage products and services

- Analysis of value-added data and customer insights in the customer value proposition

- Analysis of various product portfolios for cross-selling opportunities

- Analysis of the ancillary product offerings including insurance, maintenance, others

- Analysis of ancillary product offerings provided by associations, partnerships, JVs

- Analysis of the asset management, end of lease operations, and systems capabilities3. ProcessOrganizations need to analyse and define the optimal business processes that support their business objects. This involves the development of processes that are scalable, repeatable and whose performance is measurable. An end to end ‘As Is’ process review is recommended, which maps out clearly the process suppliers/inputs/outputs/customers and details all key dependencies. An important part of this analysis is to identify the core and non-core processes of the business, in order to identify where value is being added.Suggested areas that could be subject for review before deciding on the optimal processes include:

- Review of the existing operational model including whether it’s a centralised versus a decentralised model

- Review of the organisation’s governance and control procedures

- Analysis of the processes and services that are supported inhouse versus outsourced alongwith their interfaces and management

- Analysis of the level of outsourcing including the types of outsourcing and whetheroutsourcing is singe or multi-vendor

- Analysis of any shared service centre(s)supporting the organisation

- In a bank owned leasing entity scenario, an analysis of any processes and services supportedcentrally by the bank

- Review of any flow business processes, mass customised and any structure bespoke solutionprocesses

- Review of the customer interfaces and aspects of on-line versus off-line elements of thecustomer journey and their interfaces

4. Technology

It’s important that the chosen business model has the appropriate enabling technology infrastructure to support the people and processes.

There is a requirement to identify and implement the technology and digital systems to deliver the optimum delivery of products and services to your customers. Areas of consideration here include digitalisation adoption, data analytics and services automation.

Taking the scenario of a bank owned leasing organisation, selected areas that could be subject for review before deciding on the optimal technology platforms include:

- Review of the current operating core supporting systems/platforms covering front end, back end, CRM and reporting

- Review of the level of integration, if any, of the lease entity systems and the bank systems

- Analysis of the level of end customer and intermediary systems linkage and automation

- Analysis the systems for quotation, credit approval and asset management

- Analysis of technology capabilities and eco-system to support new products especially aroundthe areas of ‘x as a service’, and pay per usage models

- Review of the extent and quality of both internal and external data sources and the analyticaltechniques used to help support better decisioning, as well as unlocking economic value and generating customer insights.What to consider in designing an effective Target Operating Model (TOM)?The design of an effective TOM that supports your business should incorporate the key elements described above.At the outset, we recommend that you consider, what we term as the: ‘Triple S approach: S – S – S’:

- First “S”- Strategy: what is overall business strategy and what are the key underlying elements supporting the strategy covering:o Offer – products / solutions/ services

o Go To Market – segment / category of clients to whom the offer is addressed to o Channel – the route that the customer will be serviced. - Second “S” – Structure: what organization structure and operational structure is required to best support the strategy. This is the framework of the operating model.

- Third” S” – Systems: what are operational procedures and IT systems required to make the structure work effectively. This is the detailed design and implementation of the TOM.Considering that the TOM is the combination of the Second “S” (Structure) and third “S” (Systems), this approach should ensure that that the TOM is aligned to a specific business model. Note that there may be a requirement to have a few variations of a TOM within an organisation in order to support different business lines.

And finally, what are the real benefits of having an optimal Target Operating Model (TOM)?

An optimised TOM enables your business to effectively implement its vision and business strategy. Working to get the right TOM for your business will identify deficiencies and gaps in your organisation that require remediation such as redundant roles and role duplication. It provides an opportunity to optimise your business operations and reduce your operating cost base through looking at various options of appropriate insourcing/outsourcing alternatives. It also provides a significant level of internal transparency to your staff allowing clarity of roles and decision chains, often accelerating customer outcomes.

Before embarking on a major TOM review, it is worth completing an independent evaluation of TOMs that are in place with several of your organisations peer entities. This review can provide invaluable insights into your competitors operations and allow you to focus on the ‘best in class’ elements of TOM for adoption in your organisation.

Note that making changes to your business TOM can result in major transformational projects which requires a strong governance structure to monitor and control.

In summary, designing a new TOM provides you with an invaluable opportunity to optimise the size, structure and shape of your business that will deliver on your organisation’s strategies.